FinTech

From Static to Scalable: What Fintech Infrastructure Should Look Like

August 25, 2025

BLOG

Staff Augmentation, Project Outsourcing, or a Dedicated Team? How to Scale Faster With the Right Model

Choosing the right engagement model: outsourcing, staff augmentation, or dedicated teams: can make or break a software project. This article breaks down the strengths, risks, and use cases of each model with real-world examples. You’ll also learn how businesses evolve from project outsourcing to staff augmentation and finally to dedicated teams, ensuring long-term ROI, scalability, and control.

Most Fintech firms know they've outgrown their legacy core banking systems, but few understand what a modern infrastructure should truly look like. Moving beyond banking legacy systems isn't just about APIs or cloud adoption. It's about end-to-end legacy system transformation in banking, which means building for resilience, scalability, and intelligence from the ground up.

Let's unpack the key features, architecture patterns, and real-world legacy banking system examples shaping the future of Fintech infrastructure.

Modern Approach to Fintech Applications

The AI revolution is here, so it's time to accelerate innovation and modernize banking. The shift from monolithic systems to agile platforms will create a fundamental change in Fintech.

This transformation isn't just about tech. It's a strategic enabler for faster innovation, stronger security, and greater customer personalization. Let's break down the specific benefits and core components that define today's modern Fintech systems.

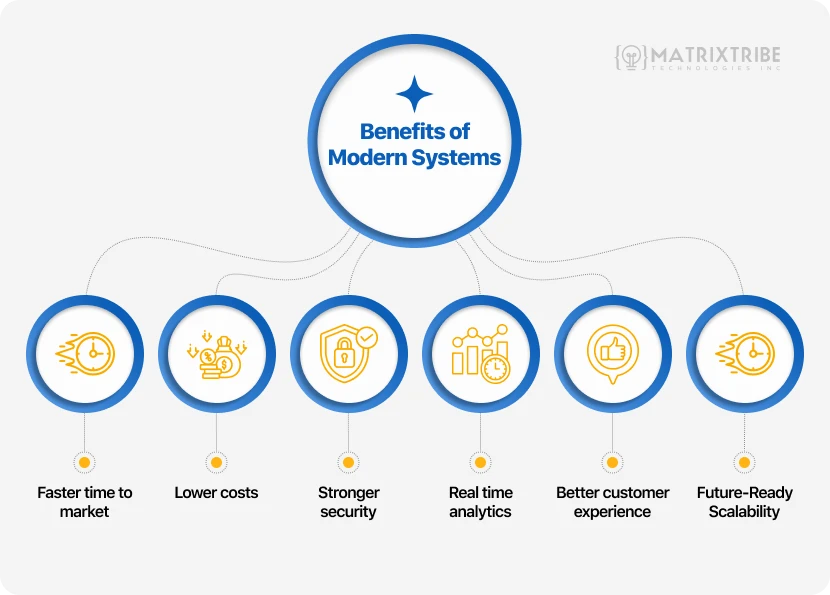

Benefits of Modern Systems

The storm of chaos led on by legacy systems can be calmed by deploying modern systems. Here we have outlined the major benefits of making a shift to modern systems.

Faster Time to Market

The modern Fintech platforms are able to eliminate bottlenecks tied to legacy deployment cycles with their modular components and API first designs. This enables the IT teams to roll out new features, integrations, and even updates in a matter of weeks, not quarters.

Lower Operational and Upgrade Costs

Modern systems reduce reliance on manual patching and legacy-specific expertise. Modular services can be updated independently, cutting both direct infrastructure costs and the overhead of large-scale version upgrades.

Improved Security and Regulatory Alignment

Cloud-native architectures support advanced security features like role-based access controls, data encryption at rest and in transit, and automated compliance workflows. This helps Fintechs stay aligned with frameworks like SOC 2, GDPR, and PSD2 by design.

Real-Time Insights and Event Responsiveness

Event-driven processing enables real-time transaction tracking, fraud detection, and behavioral analytics. Unlike batch-based legacy systems, modern architectures respond to data as it flows. Thus, powering instant profit-churning decisions.

Consistent, Personalized Customer Experience

Decoupled service layers make it easier to orchestrate consistent experiences across channels (web, mobile, embedded). APIs also allow Fintechs to enrich customer journeys with third-party data, personalization engines, and intelligent automation.

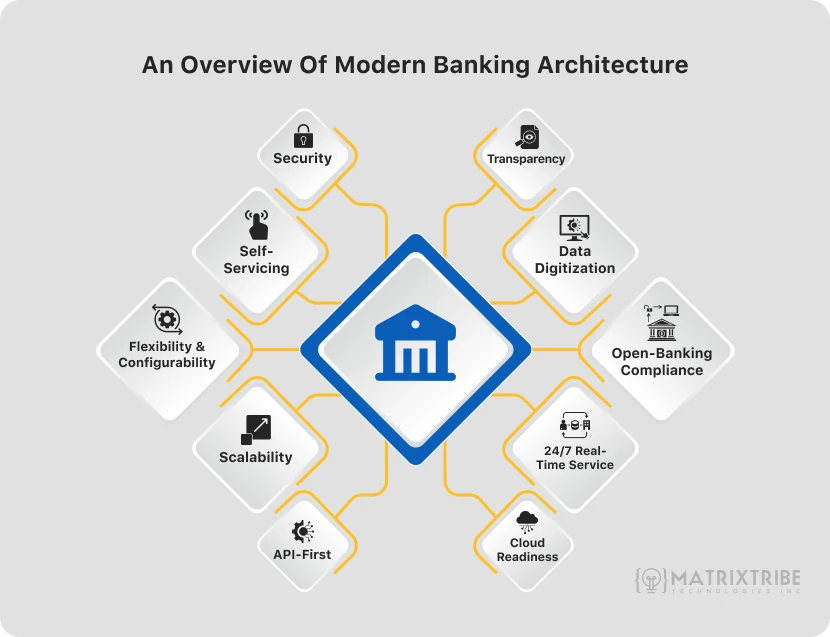

Features of Modern Banking Systems

The benefits outlined above don't emerge by chance; they're the result of deliberate design choices rooted in modern software engineering. Below are the core features that underpin today's high-performing Fintech platforms and enable speed, security, flexibility, and real-time intelligence.

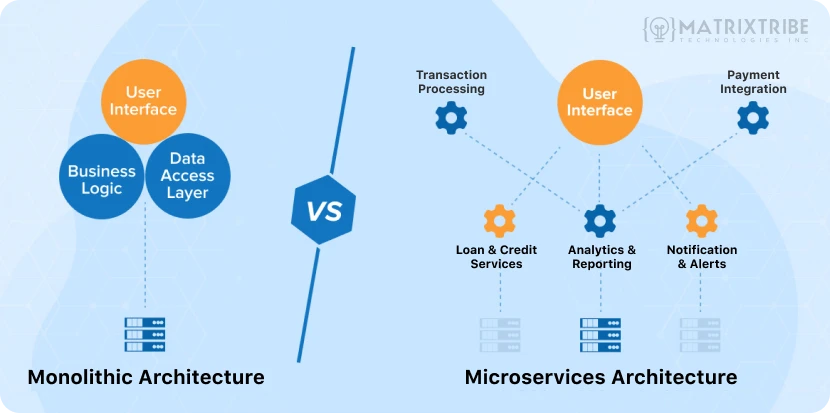

Modular Architecture (Microservices)

Instead of bundling all logic into a monolith, modern systems break down functionality into independent, reusable components. The loosely coupled components or microservices are responsible for specific functions (e.g., payments, identity verification, transaction processing).

This approach allows for modular upgrades by enabling targeted scaling of specific services. It also reduces risk as failure in one module does not end up crashing the entire system. It also accelerates CI/CD deployment pipelines without any downtime and reduces dev overhead.

API-First Design

APIs are not an afterthought; they are the product interface. Modern Fintech stacks now include RESTful or GraphQL APIs. These allow decoupling of systems, standardized communication, and enable third-party integrations.

An API-first approach ensures that every service is accessible, standardized, and integrable from day one. This empowers teams to:

Plug into services like KYC, payment gateways, and messaging platforms

Expose internal capabilities securely to partners and apps

Align easily with regulatory and open-banking requirements (e.g., PSD2)

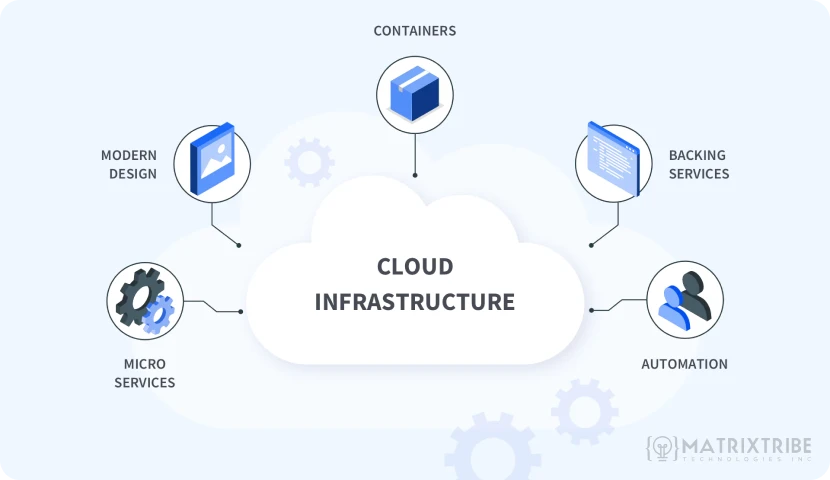

Cloud-Native Infrastructure

Cloud-native systems are built for elasticity, fault tolerance, and global scale. The cloud core baking is designed with containerized environments in mind, with tools like Kubernetes and serverless functions. This enables:

Elastic scaling during traffic spikes

Geographic redundancy for disaster recovery

Automated infrastructure management with IaC tools

With cloud native infrastructure, Fintech's can dynamically manage workloads, handle surges, and reduce infrastructure costs through autoscaling and pay-per-use models. Cloud-native also makes it easier to adopt platform-as-a-service models and optimize for cost, performance, and availability.

Real-Time Event Processing

The need for real-time processing is at its highest in the financial sector. This has led to the adoption of event-driven architectures, often powered by message queues or streaming platforms like Apache Kafka or RabbitMQ. It allows Fintech systems to respond instantly to transactions, anomalies, and user behavior. It also powers use cases like real-time fraud detection, instant payment confirmation, and live user notifications.

Embedded Security and Compliance

Security is built into each service layer through tokenization, end-to-end encryption, secrets management, and audit logging. Modern platforms now integrate compliance as code, embedding regulatory checks into CI/CD pipelines and system configurations from the ground up.

Unified Data Layer

Instead of fragmented, siloed databases, modern platforms often include a unified data layer that aggregates operational and analytical data. This supports consistent reporting, real-time dashboards, and intelligent automation across the system.

Integration Ready

Modern systems are designed with extensibility in mind. Hence, making it easy to integrate with Fintech APIs (e.g., Plaid, Stripe, Twilio), regtech services (e.g., KYC/AML tools), and enterprise solutions (e.g., ERP or CRM platforms) through adapters or SDKs.

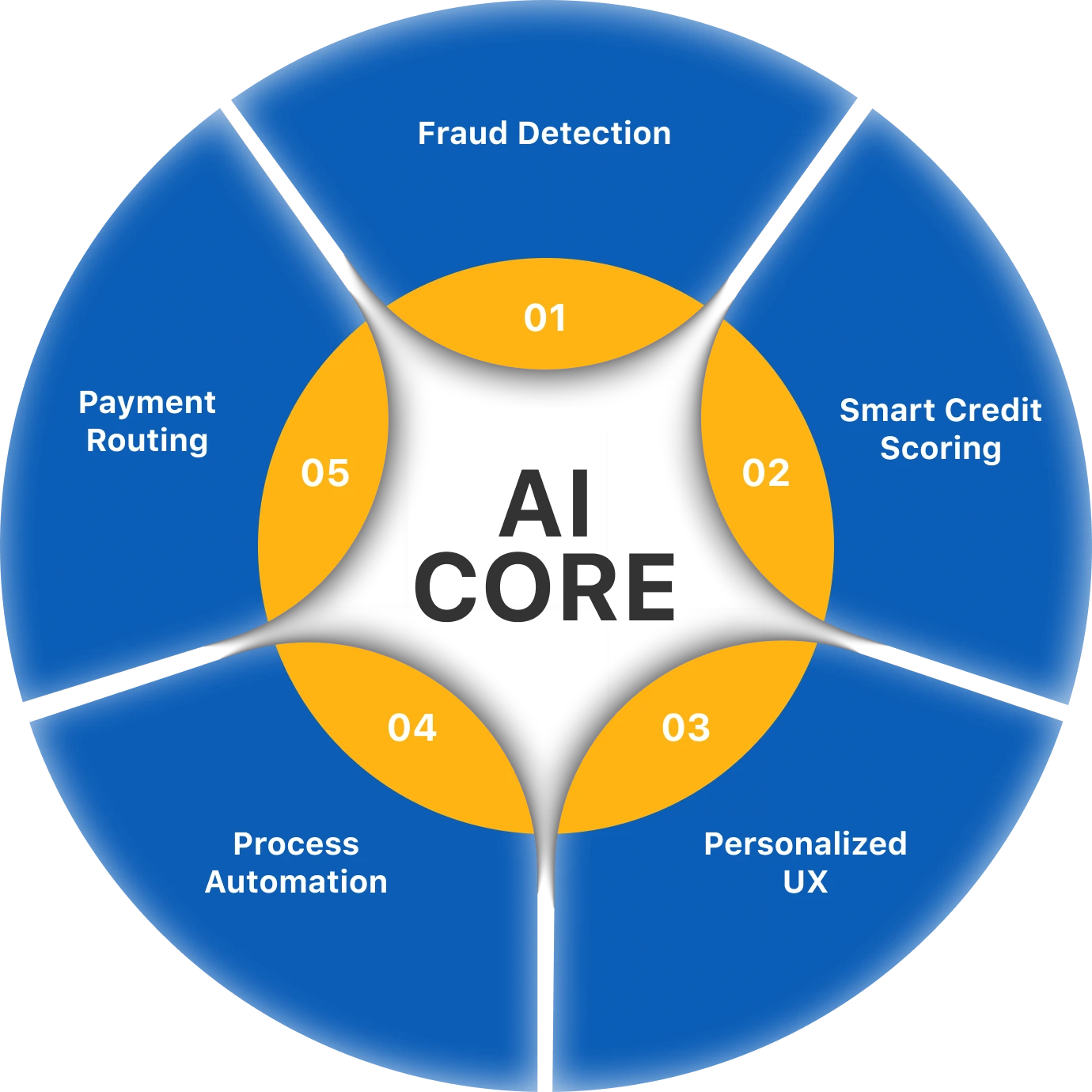

Role of AI in Finance

AI is no longer a fringe experiment in Fintech. It's an embedded capability that powers risk intelligence, personalization, and operational efficiency across the modern stack, unlike legacy systems that rely on rule-based automation or batch processing. AI-enabled Fintech platforms use real-time data, machine learning (ML), and natural language models to dynamically adapt to user behavior and market conditions.

Below are the key areas where AI delivers meaningful impact in modern Fintech applications:

Fraud Detection and Risk Scoring

Traditional fraud prevention relies on static rules that often miss emerging threats. In contrast, AI models analyze transaction patterns in real time to detect anomalies, flag suspicious activity, and reduce false positives.

Mastercard's Decision Intelligence platform processes over 143 billion transactions annually, using AI to enhance fraud detection by 20–300%, while significantly reducing false positives.

Credit Scoring and Underwriting

AI enables lenders to assess creditworthiness using a wider range of variables. These variables can be mobile usage, payment history, and behavioral patterns. This improves risk accuracy and expands access to credit.

Zest AI's ML-powered underwriting has enabled banks and credit unions to increase loan approvals by 15% while reducing defaults by 30%, according to both internal reports and Microsoft's marketplace data.

Personalized Financial Guidance

AI-driven chatbots and virtual assistants support users with budgeting advice, payment reminders, and proactive alerts 24/7. NLP models also help classify spending behavior and recommend financial products.

Intelligent Process Automation

AI augments operational processes like claims handling, onboarding, and compliance monitoring. With computer vision, NLP, and intelligent document processing, Fintechs can automate up to 70% of manual back-office tasks.

Razorpay's AI-driven smart router uses machine learning to pick the best payment path in real time. Thus boosting success rates by 4–6%. It does so by analyzing millions of transactions and adapting through feedback loops.

Frequently Asked Questions

Q. What defines modern Fintech architecture?

A. It's API-first, cloud-native, modular, and designed for real-time data processing. It allows fast iteration, secure scaling, and seamless integration with partners, regulators, and customer interfaces.

Q. How is modern infrastructure different from legacy systems?

A. Legacy systems are rigid and monolithic. Modern infrastructure is built to be flexible, composable, and event-driven. It enables continuous deployment and personalized experiences that legacy tech simply can't support.

Q. Do I need to adopt all components at once to benefit?

A. Not at all. We will modernize your system in layers, starting with APIs or microservices before evolving into full cloud-native platforms. The value will start showing up as soon as bottlenecks are removed.

Q. Where does AI fit into the modern stack?

A. AI is not an add-on. It's embedded into fraud detection, credit scoring, customer support, and internal operations.

Final Words

Modern banking infrastructure isn't optional; it's foundational. Fintechs that still rely on legacy core banking systems risk falling behind not because they're slow, but because their systems can't adapt. In a landscape driven by AI, APIs, and real-time decisions, legacy system transformation in banking is no longer a question of if, but how soon.

Step Into the Future of Financial Infrastructure

At MatrixTribe Technologies, we understand that legacy systems cannot keep up with the transformative world. We can help you rebuild while keeping scale, speed, and security in mind. Allow us to help you modernize your Fintech architecture the right way, layer by layer without any disruption.

Contact us today and learn about our way to modernize Fintech.

New Latest Article