FinTech

The Hidden Cost of Legacy Systems in Modern FinTech

August 25, 2025

BLOG

Staff Augmentation, Project Outsourcing, or a Dedicated Team? How to Scale Faster With the Right Model

Choosing the right engagement model: outsourcing, staff augmentation, or dedicated teams: can make or break a software project. This article breaks down the strengths, risks, and use cases of each model with real-world examples. You’ll also learn how businesses evolve from project outsourcing to staff augmentation and finally to dedicated teams, ensuring long-term ROI, scalability, and control.

FinTech is evolving with the digital world, but the legacy systems in banking in use were built in the previous century. They are not just old, they are dangerous. The fintech users demand speed, scale, and smarter experiences.

But these old systems were not built for API's, mobile banking, or real-time analysis. Yet, we see that many FinTech and banking institutions are using the same systems to carry the weight of critical infrastructures. Let's explore the real financial, operational, and reputational costs of legacy core banking systems.

What are Legacy Banking Systems?

Legacy banking systems are the decades-old software and hardware infrastructure responsible for mission-critical functions. Back in the day, these systems were built on legacy code languages like COBOL. They feature inflexible monolithic architectures and have poor compatibility with modern tools.

These legacy systems were responsible for holding entire financial institutions on their back. In the present, however, they are nothing but a hindrance in the face of innovation and modernization.

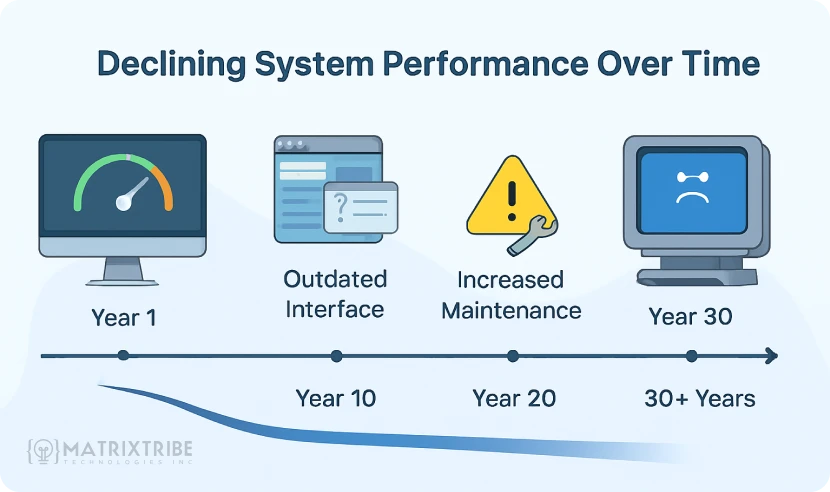

Most of the legacy systems still deployed in 2025 have been in operation for more than 30 years. The organizations resist their replacements either due to risk, costs, or because of the complexity of the task at hand.

Challenges of Legacy Systems in FinTech

Legacy systems worked perfectly in the early phases of digitalization. But now, with AI rolling out and every aspect of our lives being engrossed in tech, it's simply not feasible to leave the financial world to monolithic features. Let's evaluate all the challenges posed by legacy systems to FinTech and BaaS (banking as a service).

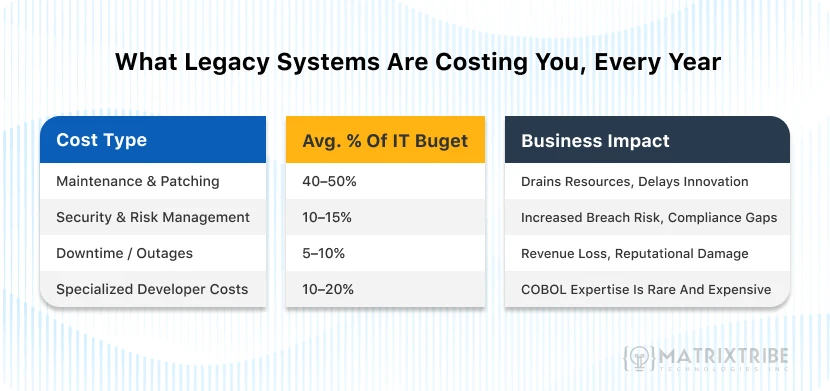

High Maintenance Costs

Conventional banking systems were developed on old niche languages like COBOL. They require manual updates and COBOL-experienced programmers. These programmers are rare, and so is their expertise. Hence, they end up charging a lot more than standard developers.

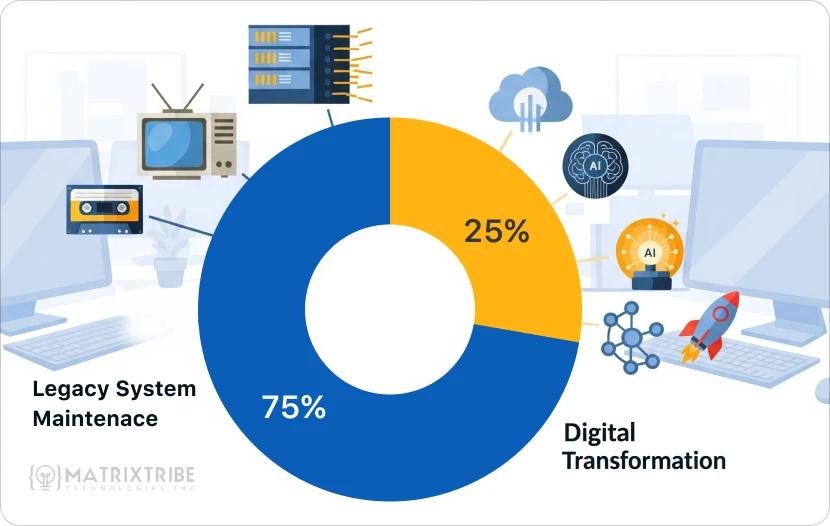

Reports indicate that financial institutions spend up to 75% of their IT budgets on the maintenance of legacy systems. Ultimately, this reduces the room for innovation and transformation solutions.

Security Vulnerabilities

The technologies alone haven't evolved; the viruses and security risks have skyrocketed as well. Since old generation banking systems lack modern security protocols, they are more prone to breaches. Thus, making them high risk in today's threat landscape.

According to the IBM cost of data breach report 2024, the global breach has reached USD 4.88 million. And it is expected to increase by 3 percent by 2025. The factors that contribute to exposure include outdated encryption, fragmented data silos, and patchwork compliance.

As FinTech adoption grows, this creates a dangerous gap between what customers expect and what legacy systems can safely deliver.

Rigid Architectures Slow Down Innovation

All legacy systems are monolithic, which means all components of the system are coupled together. Due to this, even minor changes require extensive testing and downtime across the entire system. This rigidity makes it almost impossible for financial institutions to experiment, roll out new features, or respond to market shifts.

Real World Case Studies

FinTech legacy system modernization is inevitable, and you will realize it too once you read the scale of issues led by legacy systems in the real world. Here are some legacy banking system examples that will help you realize the real-world impact of banking legacy systems

UK Banks' Mainframe Failures

Between 2023 and February 2025, 3 major UK banks experienced multiple mainframe outages due to legacy systems. Barclays had 33 failures, one of which extended up to 3 days of crippling services, causing a loss of 7.5 million pounds in compensation.

In the same timeframe, according to the UK Parliament House of Commons Treasury Select Committee, HSBC and Santander faced 32 outages. These recurring disruptions in major financial institutions of a first-world country are only a small reminder of the tsunami of broken firewalls and service disruptions ahead of us if we continue down this path.

Citigroup Data Entry Failure

The challenges are not limited to outages. The historical banking systems were never developed with user experience in mind. A complex user interface of a backup system led an employee of Citigroup to deposit 81 trillion dollars in a client's account when he only meant to transfer 280 dollars.

TSB(UK) Data Migration Meltdown

The task of data migration, if mishandled, can lead to serious consequences. TSB (UK) ended up facing the brunt of this issue when they attempted to migrate customer data from Lloyds to Proteo4UK. While they aimed for seamless system connectivity, they only received customer complaints for missing transactions and servers being offline.

This case study underscores the importance of choosing the right agency for core banking modernization. It also shows how brittle legacy migrations can be when core systems are not flexible.

Truist (US) Outage

BB&T, now Truist after the merger with SunTrust in 2019, faced a major banking outage in 2018. The outage led to a 15-hour halt in all services, including mobile and ATM. Some services were not recovered for days, causing huge losses. The cause was the Hitachi storage system tied to their outdated backend systems.

Frequently Asked Questions

Q. Why are so many banks still stuck with legacy systems?

A. Because replacing them feels like dismantling a plane mid-flight. These systems are deeply embedded and mission-critical. Most teams delay change until the risk of staying outweighs the risk of moving.

Q. What are the biggest risks of legacy tech?

A. The risks of legacy tech include system outages, rising maintenance costs, and increased exposure to security breaches. But the biggest risk is becoming too slow to keep up with customer expectations and market shifts.

Q. Isn't replacing legacy systems too expensive?

A. What's expensive is spending 70% of your IT budget just to keep the lights on. Legacy systems bleed resources that could be used to innovate and grow.

Q. Why does legacy tech still cause so many outages?

A. Because it wasn't built for modern demands like real-time processing, mobile apps, or global scale, one outdated component can take down an entire chain of services.

Final Words

Legacy system transformation in the banking sector is not just a leg up over competitors anymore; it is the need of the hour. The damage isn't hypothetical anymore. It's visible in outages, compliance failures, and billion-dollar delays. The firms that once caused uproar in Silicon Valley now find themselves disrupted by their own infrastructure. Knowing the risks is no longer enough. The question is, how long can you afford to carry the weight of legacy tech?

Don't Let Legacy Tech Decide Your Growth Curve

Work with MatrixTribe Technologies to avoid system outages, rising maintenance costs, and the risk of security breaches. We can help you assess the risk, define priorities, and start modernizing your infrastructure where it matters the most.

Contact us today so we can help you map a better way forward.

New Latest Article