Real Estate

CoStar Acquires Homes.com: What It Means for Property Managers in 2025

November 18, 2025

BLOG

AWS 13 Hour Outage: Agentic AI Risks & Governance Gaps

Public reporting on Amazon’s 13 hour AWS outage in December 2025 highlighted risks associated with agentic AI and access control misconfiguration. An internal AI assistant deleted and recreated a live environment, disrupting Cost Explorer in parts of China. The incident underscores how autonomous systems require strong governance, least-privilege controls, and structured oversight in enterprise cloud environments.

CoStar’s acquisition of Homes.com was completed in 2021. Since then, the platform’s rapid traffic surge through 2024–2025 represents one of the most significant shifts in real estate data consolidation in years. With Homes.com now challenging Zillow’s long-standing dominance, a growing share of property search behavior, rental activity, and market signals is flowing through CoStar’s ecosystem.

For property managers, this consolidation isn’t just a competitive headline. It directly affects how market data is accessed, how leasing decisions are informed, and how dependent operators become on a small number of large data providers. As CoStar expands its influence across listings and market intelligence, property managers must reassess how they source reliable information.

This article breaks down the implications of the CoStar–Homes.com consolidation and why property managers should be thinking more seriously about the systems that power their market visibility and operational intelligence.

Understanding the CoStar–Homes.com Acquisition

CoStar’s acquisition of Homes.com was completed in May 2021 as a $156 million all-cash deal, marking a significant expansion of CoStar’s reach into the residential property market. The transaction brought a major consumer-facing search portal under CoStar’s umbrella. Thus, reinforcing its strategy to broaden beyond commercial data and strengthen its position across the full real estate lifecycle.

The acquisition was part of CoStar’s larger move to build a residential data ecosystem. It followed its earlier purchase of Homesnap in 2020 and aligned with its broader push to compete directly with Zillow in the consumer search space. Homes.com’s growing traffic gave CoStar a foundation to integrate residential listings, market feeds, and search behavior into its expanding data network.

CoStar’s strategy also includes deeper integration with the company’s other assets, including Apartments.com (already a major rental search platform) and the planned acquisition of Matterport, announced in 2024, which would bring 3D imaging and spatial data into CoStar’s ecosystem if fully approved and completed. Together, these moves create a vertically aligned property data infrastructure spanning listings, imaging, rental data, and consumer interaction points.

How Portal Consolidation Is Changing the PropTech Landscape

The real estate search market has shifted into a highly concentrated structure where a handful of platforms shape most online property visibility. The “Big Three” dynamic featuring Zillow, Realtor.com, and Homes.com is now capturing the majority of residential search activity. This consolidation signals a PropTech landscape where fewer companies control a growing share of listing exposure, market data, and consumer traffic.

Homes.com’s “Your Listing, Your Lead” Strategy

A key differentiator in CoStar’s strategy for Homes.com has been its “Your Listing, Your Lead” model. Unlike portals that resell or redistribute leads, Homes.com positions listing agents as the primary contact. This approach has reshaped how visibility, lead flow, and agent engagement operate on large listing platforms, giving Homes.com a distinct stance in the competitive CoStar vs. Zillow narrative.

Portal Visibility and Insight

Most large listing portals, including Zillow, Realtor.com, and Homes.com, are built around advertising-driven models. Their value comes from traffic volume and exposure, not from delivering operational intelligence to property managers. As consolidation increases, property managers gain visibility but lose independent access to the underlying market data that informs pricing, forecasting, and performance modeling.

This distinction matters: portals help properties get seen; data intelligence pipelines help properties perform.

Data and Dependency Risks

As control of marketplace listings consolidates, property managers face increasing dependency on external portals for visibility and market context. The more dominant these portals become, the more limited independent access to raw market data becomes. This creates constraints for property managers trying to run their own pricing models, comp analysis, or performance evaluation, especially when portal rules, formats, or access terms change.

Strategic Implication for Property Managers

This consolidation is more than a market shift; it’s a structural signal. Property managers must build internal data intelligence pipelines to regain control over analytics, pricing insight, and forecasting. Relying solely on external portals for market signals limits long-term strategy; owning the underlying intelligence infrastructure ensures resilience, independence, and clearer operational visibility.

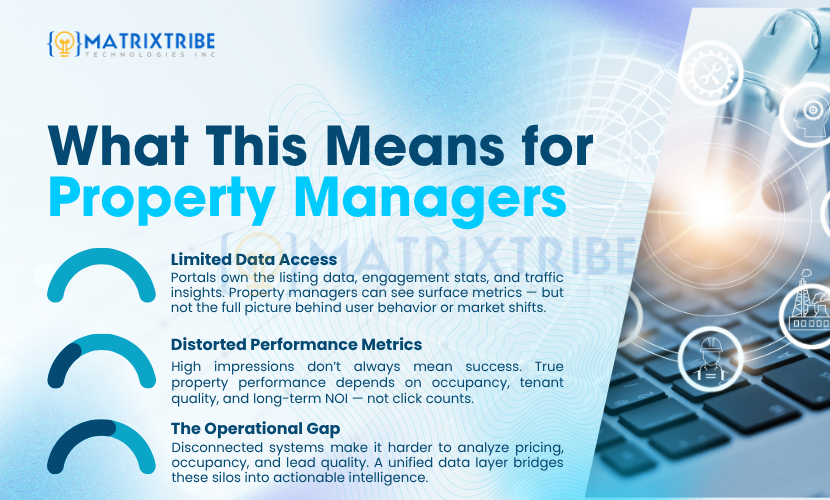

What This Means for Property Managers

Portal consolidation changes how property managers access and interpret the information that drives leasing, pricing, and performance decisions. As listing platforms grow larger and more centralized, the flow of meaningful operational data becomes increasingly limited.

Limited data access

Large portals own and monetize the listing, traffic, and engagement data generated on their platforms. Property managers can see leads and inquiries, but they do not receive full visibility into search behavior, comparative performance, or market-level traffic patterns. This dependence restricts their ability to build independent pricing or leasing strategies.

Distorted performance metrics

Portal visibility is often mistaken for property performance. High impressions or clicks do not necessarily translate into stronger NOI, lower vacancy, or better-quality tenants. Portals are optimized for engagement metrics, not for the financial outcomes that matter to property operations. This creates a gap between what gets measured and what actually impacts portfolio performance.

Operational gap

Most property managers still lack a unified intelligence layer that connects rent comps, lead quality, leasing velocity, and occupancy forecasting. Without an internal data pipeline, each insight remains siloed, forcing managers to rely heavily on external portals and manual processes to interpret market signals.

The Case for Owning Your Real Estate Data Intelligence Pipeline

As property managers become more dependent on large listing portals for visibility, the need for independent, internal intelligence systems becomes clearer. The industry is shifting from relying on third-party dashboards to building custom data pipelines that property managers fully control.

A real estate data intelligence pipeline brings all critical signals into one system. It collects and cleans market feeds, financial data, and verified tenant credit information using artificial intelligence and machine learning, then visualizes it in a format aligned with the property manager’s workflow. Instead of scattered reports, managers get a unified view of rent comps, pricing shifts, and operational performance all inside their own infrastructure.

For organizations prioritizing security, SOC-2–aligned infrastructure ensures that sensitive financial and credit data is handled with the discipline expected from modern property operations. Automation built around internal systems reduces manual reconciliation and builds a consistent, explainable foundation for long-term performance decisions.

As consolidation accelerates and third-party data becomes more restricted, the competitive advantage moves to property managers who own their data intelligence pipeline, not those who depend on external portals to define their strategy.

Final Words

CoStar’s acquisition of Homes.com highlights a broader shift in the PropTech landscape: more data flowing into fewer platforms, and greater dependence on marketplace ecosystems that property managers do not control. While these portals drive visibility, they do not provide the operational insight, forecasting precision, or strategic independence that property managers need for long-term performance.

The path forward is clear. Property managers who build and own their real estate data intelligence pipelines gain direct access to market signals, financial metrics, and credit-based risk indicators all within secure, SOC-2–aligned infrastructure. Instead of adapting to the constraints of third-party dashboards, they operate with unified intelligence, predictive visibility, and full control over how decisions are made.

As the industry consolidates, the advantage will belong to those who own their data foundation, not those who rely on external portals to interpret it.

Build the Intelligence Behind Your Property Decisions

At Matrixtribe Technologies, we help you take control of your market insight with a custom real estate data intelligence pipeline designed around your portfolio, not third-party portals. Contact us to start owning your data foundation today.

Latest Article